When Amazon representatives hit industry trade shows in 2016, rumblings about the e-commerce giant’s move into live plant sales swept the industry. Reactions ranged from warnings to welcomes. That ambivalence deepened with the recent launch of the Amazon Plants Store, adding a designated live plant space to the company’s already extensive lawn and garden offerings.

Whatever your position on Amazon, understanding how this massive dotcom functions — and how online sales by brands, growers, independent garden centers and other sellers fit in — can help you position your nursery for the new world ahead.

Putting Amazon in perspective

Amazon isn’t the only retailer affecting the nursery industry, but it’s hard to ignore its impact. In an annual shareholder letter released to media on April 18, Amazon.com CEO Jeff Bezos reported the company’s 2017 revenue hit $178 billion, a 31 percent increase from 2016. E-commerce analytics provider One Click Retail translates that figure to 4 percent of all U.S. retail sales and 44 percent of all U.S. e-commerce sales.

Bezos also confirmed that paid Amazon Prime memberships passed the 100-million mark in 2017. For an annual $119 fee, Prime members enjoy perks such as free two-day shipping — even on live plants — plus everyday deals and exclusive sales.

Along with Amazon’s general sales, the company’s lawn and garden sales are growing, from lawn equipment and grills to pruners, fertilizers

Amazon sales and sellers simplified

To appreciate the scope of Amazon.com, understand that Amazon is not the only company selling on the site. In addition to items retailed by Amazon itself — noted as “sold and shipped by Amazon” — consumers shop from 2 million independent sellers that comprise the Amazon Marketplace. Amazon’s platform seamlessly integrates Marketplace offerings with their own retail offerings, while listings advise attentive shoppers which parties offer and ship the items being sold.

Amazon.com spells out basic Marketplace selling fees in “Make Money with Us” links at the bottom of its pages. Professional marketplace sellers list unlimited products for $39.99 per month plus “referral fees” on sales — 15 percent for Home & Garden products as of June 2018. Amazon handles all credit card payments, deducts referral fees and deposits the remainder directly into seller accounts every two weeks.

Amazon Marketplace sellers can handle their own shipping, known as Fulfillment By Merchant (FBM). Or they can ship

Amazon’s Marketplace sales have grown as more businesses, including many live

As noted in Bezos’s letter, more than 300,000 small and medium U.S.-based businesses became Marketplace sellers in 2017. In a first, Marketplace sales accounted for half of all items sold on Amazon.com for the year.

Amazon plants from a grower perspective

Marketplace sellers have offered live plants on Amazon.com for more than a decade, but the launch of the Amazon Plants Store signals a new era. Amazon itself now sells live plants ranging from bonsai, succulents

According to an Amazon spokesperson, all live plants are sold through the Amazon Plants Store, regardless of who the seller is. As many as 100,000 live plants or seed items may be offered on the platform at any given time, depending on the season.

Four Star Greenhouse, the No. 1 supplier of Proven Winners, serves as an Amazon fulfillment center for “sold and shipped by Amazon” Proven Winners stock, from annuals to shrubs. But that doesn’t equal an exclusive. Independent Marketplace sellers can and do still sell Proven Winners plants, along with plants from virtually every major plant brand.

For Tom Smith,

“We wanted to do the best we could for the brand,” he says. “When Amazon came to us to be a fulfillment center, we knew either we do it or someone else would. It makes us nervous. If they ship a poor-quality plant from another source, that wouldn’t represent the brand well. Your reputation can be based off a poor grower that just puts plants online,” Smith explains.

As an Amazon fulfillment center, Four Star ships plants

All the Proven Winners line will be represented on Amazon, though items will list as “not in stock” at times.

“They don’t commit to any numbers. It’s a wild card on Amazon, so it’s basically what we have available,” Smith says, adding that availability is a challenge.

“You have to get people out there counting plants, pot by pot, because that’s what you’re selling now — not cases — and you better be dead-on right,” Smith explains. “This isn’t something you can do once a week. It’s a daily process. If you don’t deliver or you deliver bad quality, you’re gone.”

Smith believes Amazon plants won’t compete with box stores on price, even with Amazon’s efficiencies. “I’m not even sure if they’re making money at their current prices, which are higher than the average garden center now,” he says. “[The appeal of] online is convenience; it’s not pricing.”

Grower-retailer perspectives

With growing facilities, three retail garden centers, and a thriving wholesale business, Pennsylvania-based Esbenshade’s Garden Centers began selling on their own website in 2005.

“We were looking at opening new stores or creating a new revenue stream, and we decided to start offering the products we sell in our stores to customers online,” says second-generation owner Terry Esbenshade.

The

Factors, fees

Hard goods constitute most of Esbenshade’s online sales, though plants are a focus. One challenge is compliance with plant regulations in all 48 contiguous states — something Esbenshade feels many online sellers ignore.

“We’re playing by the rules, and we’re up against competition that, at this point, is doing whatever they want,” he says.

A search on Amazon supports those concerns.

Like Smith, Esbenshade emphasizes the stringent requirements tied to Amazon selling privileges, but business has been robust. The company plans to expand on Amazon and other online sales channels, including a new dotcom of their own by year end.

“The goal is to continue growing our online presence through an omnichannel perspective. We don’t want all of our eggs to be in one basket,” Esbenshade says.

(Editor's note: In May 2019, Esbenshade Greenhouses partnered with Bower & Branch. Now, if a customer is looking for a tree or shrub that is not available in one of its three retail locations, they can purchase online from Bower & Branch and have it delivered directly to one of those store locations.)

Online retailer Garden Crossings in Zeeland, Mich., started as an online mail-order business in

Several factors influenced that decision, but concerns about quality and customer success keep the retailer focused on their current business.

“One primary reason we don’t do business on Amazon is that you can’t take orders in winter for spring shipment,” says owner Heidi Grasman. “I’m not going to ship when it’s inappropriate for a zone. Amazon is ship-on-demand.

“Our main goal is we want the customer to have success in what they’re growing. If they don’t, it’s ultimately a reflection on us,” Grasman continues. “Quality and customer success are our No. 1 things, so we prefer to do it solely through our website and not to do business on Amazon at this time.”

Selling restrictions and independent-only promises

As online sales grow, concerns about brand integrity and exclusivity build among brands, growers

“Brand manufacturers don’t know how to navigate it, and they’re extremely concerned with protecting brand integrity,” Esbenshade says.

Vendor

As a local store and online seller, Esbenshade is concerned about brands that offer independent-only products, which then end up sold directly by Amazon. While he’s seen this more with hard goods than plants to date, he’s worried the practice may spread.

“If we’re selling it, it’s always going to be cheaper in-store. But if Amazon is selling it, that’s different,” he says. “We kind of like Amazon, and we kind of feel like we don’t like Amazon. It’s a really weird relationship. The manufacturer can keep it out of Home Depot or Lowe’s, but what are they going to do about Amazon.com? I’m talking about products Amazon is able to obtain and directly sell themselves — not third-party sellers,” Esbenshade continues. “My question is, how is Amazon.com as a seller any different than Lowe’s and Home Depot? I think there’s going to be more manufacturers policing that, but it’s only going to happen when IGCs put pressure on them to do so.”

What does it mean for your nursery?

As Amazon advances in live plants and other categories, views about online sales as threats or opportunities for nurseries and brick-and-mortar IGCs continue to differ.

Industry consultant Sid Raisch, president

“Convenience buying is leading this and creating new and well-entrenched habits among consumers,” he says. “Once someone buys a plant successfully online, they will repeat over and over again just like all the other products sold online today.”

Raisch suspects that this year’s delayed spring may lead growers to turn to Amazon sales, whether to eliminate surplus stock or establish a new path to consumers. Amazon’s extensive customer base is one advantage he sees for growers that make that move.

“There is more traffic in any category on Amazon than in any retail store. And unlike brick-and-mortar retailers, they are open 24/7/365, accept all forms of payment, and already have customer relationships of trust with accounts set up, including Prime,” Raisch says.

Even so, he advises caution for those considering Amazon sales.

“I only know what I hear from others and read because [Bower & Branch is] not selling on Amazon. What I hear is that sellers of all types are continually and progressively squeezed by Amazon as volume builds,” he says. “Amazon is relentless in extracting

That’s not Raisch’s only concern. “The main con is the race to the bottom that Amazon facilitates on their platform. They pit seller against

(Editor's note: Raisch left Bower & Branch in January 2019)

Smith hopes that Amazon sales will benefit nurseries and traditional garden retailers in the long run. He believes that plant listings with extensive, accurate plant information — covering hardiness, dormancy, container size, seasonal appearance and life cycle — will serve as both shopping tools that generate local garden center sales and educational tools that reach a new pool of non-gardeners where they shop.

“I’m optimistic,” Smith says. “I don’t see this as displacing independent garden centers at all. I see this as an opportunity to continue to grow with garden centers and build [a larger] consumer base. I’m hoping this is the kind of gateway that helps people become gardeners, especially millennials and people always on their phone, and brings them into gardening and garden centers.”

Explore the July 2018 Issue

Check out more from this issue and find your next story to read.

Latest from Nursery Management

- Dümmen Orange North America celebrating 25th anniversary in 2025

- Redesigning women

- Illinois Landscape Contractors Association changes name to Landscape Illinois

- 2025 Proven Winners Horticulture Scholarship applications now open

- ICL’s Gemini Granular herbicide now registered for use in California

- Eurazeo Planetary Boundaries Fund acquires Bioline AgroSciences

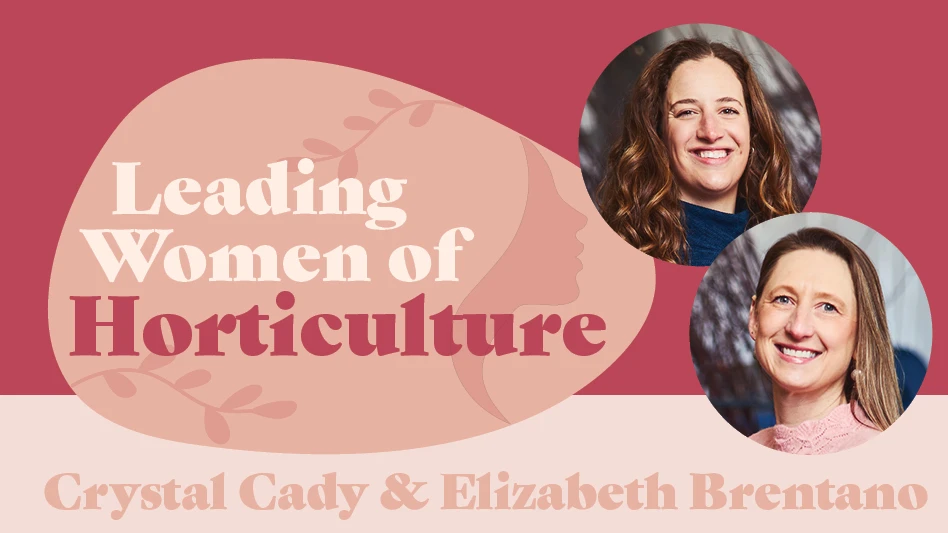

- The Leading Women of Horticulture

- Leading Women of Horticulture: Dana Massey, Plantworks Nursery